Forget E. F. Hutton; when Warren Buffett talks, people listen. And I don’t feel like that’s simply because he’s the world’s most famous investor, though he is. He’s a person of wisdom. A wisdom that seems to have been applied not only in his investing, but also in his marriage, his parenting, and his own personal finances.

So when he recently offered his personal advice on estate planning—on how, when, and why you should talk to your kids about your estate plans—it certainly got my attention. And it offers a framework for all of us, regardless of our net worth, regarding how we can have better money conversations with the people who depend on us the most.

In addition to getting a dose of Warren’s wisdom, we’ll also get Tony’s, as he breaks down the big moves in the market from the past week.

Thanks for joining us for the FLiP weekly!

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this FLiP weekly you'll find:

Financial LIFE Planning:

How, When, And Why To Talk To Your Kids About Your Money

Quote O' The Week:

Margaret Mead

Weekly Market Update:

Price Matters

Financial LIFE Planning

How, When, And Why To Talk To Your Kids About Your Money

Buffett’s Estate Planning Advice

“When your children are mature,” Buffett said, “have them read your will before you sign it.” So, the when is pretty clear—when our children are mature and before our will is signed. But how?

“Be sure each child understands both the logic for your decisions and the responsibilities that they will encounter upon your death.” Buffett’s instructions on how also require another step here, because to explain the logic and the roles children play in our wills, we have to understand them. You need to know your plan well enough to explain it.

This wisdom can—and should, I believe—be applied in every aspect of our personal finances. I realize that there may be many intricate complexities of some financial strategies and vehicles that require the guidance of a professional. Yet, a great rule of thumb in personal finance is that you shouldn’t enact a strategy that you can’t explain to a 5th grader. (Thanks, Larry Swedroe.) And yes, that means if you currently have strategies in place that you don’t understand, I recommend reaching out to your financial advisor to gain that understanding.

But you’re not likely to put this good advice to use without understanding why, and Buffett doesn’t leave us hanging here. He says, “You don’t want your children asking ‘Why?’ in respect to testamentary decisions when you are no longer able to respond.”

Indeed, it’s hard enough for a family to navigate the loss of a loved one, and our estate plans are, quite literally, our last words to those we love the most. Too many estate plans—either for lack of effective planning or lack of effective communication—result in a last word that is mysterious or confusing, at best. And we can eliminate that confusion by discussing our plans before we’re gone.

Estate planning certainly isn’t the first or only time we’ll have an opportunity to discuss money with our children, so how can we apply this why, when, how framework in discussing money with our kids?

Why?

First, let’s retrace why we’d discuss money with our children in the first place. Notably, Buffett comes from a generation for whom discussions of money, with just about anyone, were considered taboo. But is it not our chief responsibility as parents to raise our children to be independent and contributing members of society? How else will they learn how to grow, protect, give, and live, if not from us? (And no, despite an enormous effort to integrate financial literacy and wellness into our educational systems, we’ve largely failed at changing our archaic approach to academia.)

And here’s the best why I’ve ever heard for being willing and able to articulate your financial and life lessons to your children:

We want to get there first.

Whether the topic is sex, drugs, rock’n’roll, or money, we want to get there first as parents. We want to provide our children’s foundational understanding of these most important issues before they come home from school or a friend’s house having had their foundation poured by some kid with an opinionated older sibling.

When?

So, we have to know our opinion before we can share it, but how do we know when to share it?

Buffett gave us two instructions here, one that is clear and one that is a bit more nuanced. First, he tells us to share—in this case, our estate plans—when our children are mature. That, of course, will be a sliding scale for each child, parent, and topic.

I can imagine that having your kids read your will falls later, if not last, on this inculcation timeline, if only because reading legalese is over the heads of most seasoned adults. Yet, learning how to spend, share, and save via three jars in the kitchen can come much earlier, followed by understanding credit and money in the digital domain, borrowing, taxes, insurance, and one of the most fertile fields for financial understanding—education planning for your children.

But how do we know when our kids are mature enough to handle these topics? When they demonstrate genuine curiosity.

Yes, this means that it’s not a planned schedule on the calendar of couch speeches. It requires a fluid approach and the ears to hear when our children express genuine curiosity. Even then, it may require unearthing the root question that really needs to be satisfied—and choosing an age-appropriate answer.

Now to the more nuanced point Buffett makes through his advice. He said, “When your children are mature”—check—“have them read your will before you sign it.” Before we sign it, Warren, but why?

I surmise here that this is yet another opportunity to grow our kids up. By having them review our wills before we sign; by discussing our move before putting the sign in front of the house; by letting them know our role was downsized right before their junior year of college, putting the private school tuition out of range; by discussing the opportunity to buy a second home; by enlisting them as part owners (however small the percentage of ownership) in these decisions that certainly feel big for them, we are using these conversations as one more opportunity to add to our children’s maturity resumes. And we are normalizing these weighty decisions when they are still under our care, better preparing them to make those decisions as adults.

How?

But how?

Let’s use the classic example that has persisted through generations. Your teenage kid asks, “How much do you make?”

They’ve expressed curiosity, but does that mean it’s time to hand over your paystub? Probably not. Let’s follow Simon Sinek’s advice and “start with why.”

“I appreciate your question, and I’m wondering what sparked it. Why are you curious how much I make?”

You may have to ask a few questions to arrive at the motive, and that, combined with your intimate understanding of your child’s maturity, will no doubt illuminate your final answer. And it’s possible, if not likely, that your answer won’t even include any numbers. Remember Buffett’s advice here: “Be sure each child understands both the logic for your decisions and the responsibilities that they will encounter…”

In my experience, the younger our kids are, the more logic itself will suffice—but as our children age and mature, it’s altogether possible that actual numbers will be beneficial, if not necessary. After all, especially as it relates to the subject that was our launching point, estate planning, our kids will eventually find out what the numbers are. Therefore, in lieu of making it a total surprise, shrouded in mystery, why not discuss it now—invite them into the discussion, teach them the logic behind your decisions, enlist them in the implementation of your plans, and help them learn how to make life’s most important decisions with competence and confidence.

So, I’m curious: do you feel better prepared to have your next meaningful money conversation with your kids, regardless of their age?

This article was originally published in Forbes.com.

Quote O' The Week

Insight from the renowned cultural anthropologist who lived from 1901 to 1978:

Margaret Mead

"Children must be taught how to think, not what to think."

Weekly Market Update

Another healthy up week for the markets:

+ 1.74% .SPX (500 U.S. large companies)

+ 1.21% IWD (U.S. large value companies)

+ 1.43% IWM (U.S. small companies)

+ 0.80% IWN (U.S. small value companies)

+ 2.33% EFV (International value companies)

+ 2.48% SCZ (International small companies)

+ 0.09% VGIT (U.S. intermediate-term Treasury bonds

Price Matters

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

Over the long run, stocks tend to track corporate earnings trends. But there are times when the stock market can get over or undershoot those earnings, resulting in rich or cheap valuations. Those periods of deviations can set the stage for stronger future returns in the case of lower valuations or a period of weaker future returns when valuations are higher.

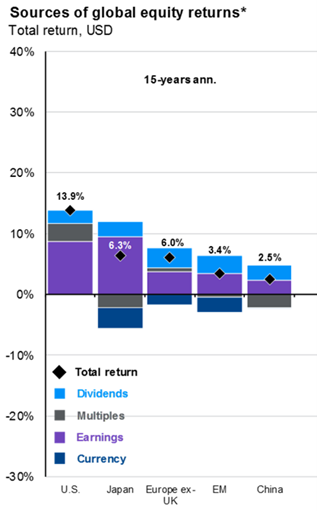

One of the more persistent trends of the investment cycle ever since the Global Financial Crisis has been U.S. large cap outperformance. Much of that performance has been driven by superior earnings growth, but not all of it. The illustration below shows that the U.S. equity market has grown about 14% per annum over the past 15 years, and embedded in that growth has been about 8% earnings growth (the purple bar). Interestingly, Japan has grown earnings by about 1% point more but failed to match the total return of the U.S. The difference has primarily come from higher valuations and a stronger currency in the U.S., with lower valuations and a weaker currency in Japan.

Chart Source: JPMorgan Guide to the Markets

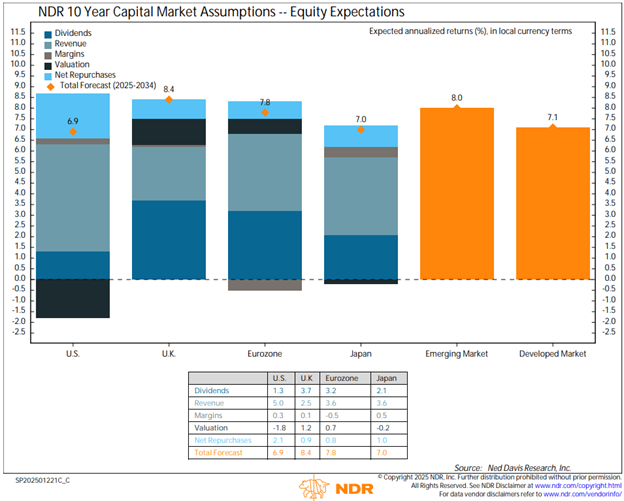

No other major global region has seen its valuation expand quite like the U.S. market. What’s the implication? Our friends at Ned Davis Research (NDR) recently released their 10-year capital market assumptions. In those, they bake in a meaningfully higher revenue growth rate for U.S. companies relative to international companies. Yet they still expect U.S. stocks to experience a lower total return over the next 10 years, as shown in the chart below. What gives? Simply, “price matters.” They assume that valuations will normalize through 2034 for the U.S., which would tamp down the total return.

Chart Source: Ned Davis Research

Some firms are taking a more dire perspective on large cap U.S. stocks, but we’re not sure those prognostications are appropriate for several reasons. The above analysis is much more balanced. Also, the team at NDR also views the U.S. dollar as overvalued. A period of dollar weakness could be another tailwind for international shares from the perspective of U.S. investors. We have invested with a home country bias and have generally been overweight in U.S. shares for years. But because we believe price matters, it also makes sense to hold some international stocks in one’s portfolio.

The Message from Our Indicators

The U.S. economy ended 2024 on a high note. The Atlanta Fed GDP is currently tracking a 3% rate of growth for Q4, with a notable contribution from consumer spending. We expect the economy to ease somewhat this year as inflation-adjusted incomes continue their trend lower, owing to a loosening labor market. However, at a 3% real growth rate, there is room for some economic cooling without a resulting recession. One of last week’s more impactful data points was the U.S. New Tenant Rent Index tracked by the Bureau of Labor Statistics. That index showed a meaningful drop in Q4. Strategas Research Partners notes that new rents lead the shelter component of the consumer price index (inflation) by four quarters. The implication is that inflation pressure may ease throughout the year, allowing the Fed to cut further interest rates.

The strong Q4 economic backdrop has thus far been showing up in the earnings reporting season. According to Wisdomtree, earnings growth is expected to be 12.4% for the S&P 500. Small cap companies in the S&P 600 Index are expected to grow earnings by 7.7%. These relatively healthy earnings growth numbers currently support the bull market in stocks, despite lofty valuations. We would note that the market has typically maintained an uptrend as long as earnings growth is positive, which is currently the case.

From a technical perspective, December was a weak month, and market participation began to falter. However, January has largely seen a positive reversal in those trends. Earlier this year we noted that a weak December would not necessarily be a bad condition if it were followed by a rebound in January. So far, so good from that perspective. Market sentiment cooled quite a bit following the year-end lull. Sentiment has been working higher, but optimism is not yet pervasive. With a supportive economic and earnings backdrop, the bull market remains intact.

Your weekend isn’t dependent on an intact bull market—but it surely doesn’t hurt! Speaking of pain, I think I speak for most Baltimorons crushed by last weekend’s loss when I say, “Let’s go, Bills!” 😁

Tim