Sahil Bloom recently shared a jarring stat: “By the time your child turns 18, you've spent ~95% of the time you will ever spend with them in your lifetime,” based on research from the American Time Use Survey done by Our World in Data.

At first glance, many parents feel a sting of, “Geez, am I being [or have I been] a poor steward of the limited time I’ve been given to spend time with my kids!?” But I don’t think this is a revelation rooted in guilt.

Furthermore, as someone with two older kids (21 and 19) and one much younger (17 months😬), I can tell you that some of the most priceless moments I’ve spent with the older kids occurred after they were 18.

And perhaps that’s the point. This statistic is simply a reminder to heighten our awareness, to better appreciate those younger moments that often feel more like monotony or even drudgery—and then to do a better job crafting experiences that will maximize those valuable memories that we hope will mark our relationships with friends and family at any age.

This week, we offer a 4-step Method For Maximizing Memories With Money, and yes, our personal stock market guide, Tony Welch, updates us on another volatile week.

Plus, we have a bonus video podcast episode where Tony breaks down the current Tariff Tantrum going on in the markets and we can respond to them.

Thanks for joining us!

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this FLiP weekly you'll find:

Financial LIFE Planning:

Maximizing Memories With Money

Bonus Podcast:

Tariff Tantrum—What’s Going On??

Quote O' The Week:

Cesare Pavese

Weekly Market Update:

Trees Don’t Grow to the Sky

Financial LIFE Planning

Maximizing Memories With Money

spending money on experiences is the way to get the most bang for our buck. Or, as Kumar, Killingsworth, and Gilovich put it in their 2020 study, "People derive more satisfaction from experiential purchases (e.g., travel, entertainment, outdoor activities, meals out) than material purchases (e.g., clothing, jewelry, furniture, gadgets), both in prospect and retrospect."

So, how can we maximize these experiences—these memories we’re creating—and increase the rate of return on the money we invested? Perhaps from an unlikely place. I recommend applying an evidence-based approach to relationship management that I learned from author, consultant, and former actuary Mo Bunnell:

1. Listen & Learn

One of the best pieces of parenting advice I ever got was that, to optimize the lessons I hope to instill in my children, I need to give up on the proactive lecture [sigh] and instead be ready to deliver the important (and hopefully concise) insight reactively, at the moment that the kids express their curiosity.

While I’ve not always followed this excellent advice, it has borne much fruit when I have— especially on the big stuff. With stuff like faith, family, work, money, education, sex, drinking, drugs, and rock-and-roll, it’s been more natural to address these matters when the kids make a comment or ask a question. And trust me, parents, if we have ears to hear, they will signal their curiosity, and we will learn from our kids.

This works no differently in crafting the best experiences of any size or scope, and with anyone, but especially our family members. If and when we become students of those we love, they will show us what interests them.

This post was inspired by a quote from Sahil Bloom, author of “The 5 Types of Wealth.” I had the opportunity to talk to Sahil about the book, and you can catch that video podcast HERE.

2. Create Curiosity

Then, we have an opportunity to pour fuel on the fire of that nascent curiosity. If your kids show interest in trains, why not ask them on a Saturday morning if they would be interested in going to a nearby train station? If they show interest in plants or flowers, ask them if they might like to plant a seedling or build a raised-bed garden with you. They show interest in music, ask them if they’d like to go to a concert.

Now, I realize that we can’t make every shred of curiosity into an extravagant occasion—and nor should we. Money is great memory fuel, but while most experiences cost something, they need not be expensive to captivate our attention and leave a meaningful mark.

3. Build Together

And with kids (of any age), we may need to redirect their curiosity into a more reasonable (or less costly) direction—but without putting a wet blanket on their inquisitiveness.

“Well, going to the moon may not be in the cards, but what about a trip to the planetarium?”

“What’s a planetarium?”

“Ooh, it’s a special place where…”

One of the keys to memory maximization is giving our loved ones a chance to have some agency in the experience we’re planning. You might love live music, and you may have good reason to introduce your kids to music you love—but what about asking them who they would like to see in concert?

Maybe you even create a rhythm of going back-and-forth between who chooses the next musical act you’ll see. This is an approach that I have directly benefited from, as I’ve now had unforgettable experiences seeing U2, Kendrick Lamar (twice), Mumford & Sons (twice), JID, My Morning Jacket, J. Cole, Tame Impala, and many smaller acts, all with my young adult kids—and you can guess which ones were their ideas. (You might be surprised. 😊)

4. Build Up and Look Back

Here, we divert from Mo Bunnell’s method and back to the wisdom gained from the above-referenced study: “People derive more satisfaction from experiential purchases … than material purchases … both in prospect and retrospect." (Italics are mine.)

You know this to be true, right? One of the key factors adding to our most memorable experiences is anticipating that experience and rehashing thereafter.

Before all those concerts, for example, we made up playlists enshrining our favorite songs that we would listen to weeks in advance and on the way to the show. Then afterward, we’d bounce back-and-forth discussing our favorite moments of each show—and creating a sharable playlist from the night’s setlist.

Now, years beyond any of those events, every time one of those songs comes on when we’re all together (or apart), we’re immediately taken back to the sights and sounds of these indelible memories.

The total value derived from those memories has long ago exceeded any investment—and that is my hope for you.

So, what memory can you begin planning to maximize this week? What information have your loved ones already shared that you can use to spark their curiosity? What experience can you build together, anticipate, and remember forever?

Bonus Podcast

Tariff Tantrum - What's Going On?

Tim and Tony talk through the current Tariff Tantrum and offer insight into what's going on and what we can (and can't) do about it as investors.

Quote O' The Week

This Italian novelist struggled with mental health, but seemed to tap into a sense of deeper meaning:

Cesare Pavese

“We do not remember days; we remember moments.”

Weekly Market Update

Everything was green this week:

+ 4.59% .SPX (500 U.S. large companies)

+ 2.33% IWD (U.S. large value companies)

+ 4.10% IWM (U.S. small companies)

+ 3.27% IWN (U.S. small value companies)

+ 3.36% EFV (International value companies)

+ 2.54% SCZ (International small companies)

+ 0.35% VGIT (U.S. intermediate-term Treasury bonds

Trees Don’t Grow to the Sky

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

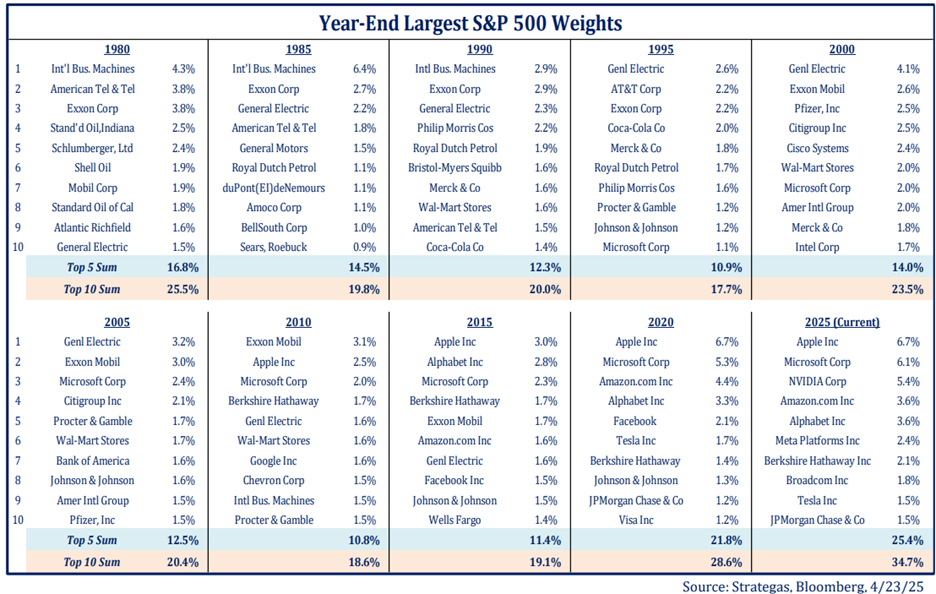

The table below shows the largest 10 stocks in the S&P 500 Index at the end of five-year periods starting in 1980. It’s fascinating to see how much the composition of the top 10 tends to shift through time.

Some companies have had more longevity than others. In 1980, IBM was the top stock and it continued to be so through 1990. But, by 1995, not only did it fall from the top stock, but it fell completely out of the top 10. GE had a similar run from 1995 to 2005 but began to descend in the list by 2010. It is also interesting to see some other names on the list and how they move through time. For instance, Energy companies took up 7 slots in 1980 and zero slots by 2020.

One takeaway is that trees don’t grow to the sky. Once a stock ascends to the upper echelon of market cap in the index, almost definitionally, a lot of good news has been priced in. Inevitably, creative destruction or other themes will captivate investor attention. The top 10 list is populated with very successful companies, but if history is a guide, the list could look completely different 10 to 15 years from now. Successful investing is less about paying for past growth and more about finding future growth.

The Message from Our Indicators

The economy likely remains in expansion mode but there has been at least some loss of growth momentum due to trade uncertainty. For example, the April estimate of the S&P Global Purchasing Managers Index (PMI) came in at 51.2, the lowest level in 16 months. The 50 level delineates contraction and expansion, so the PMIs still indicate expansion in the service and manufacturing sectors, albeit slower. A three point drop in the service sector led to the weaker PMI reading. Reduced tourism played a role, especially in a -17.2% drop in annual tourists from the EU.

Somewhat troubling is a pickup in price pressures from the PMI surveys. Pricing in the PMI surveys tends to lead consumer inflation by about three months. The last inflation print was benign, but forward-looking indicators suggest a pick up in inflation, especially ex-housing, is likely. Speaking of housing, new home sales beat economist estimates but existing home sales came in weak. Homeowners are hesitant to sell owing to their existing low mortgage rates. The economic data suggests slowing growth but is not yet consistent with recession.

Earnings season is in full swing. Thus far, 157 S&P 500 companies have reported representing 29% of the index weight. The reported earnings growth rate has been 15% on sales growth of 4%. That implies that there has been solid profit margin expansion for those companies that have reported thus far. That’s important because trade policy could have a negative impact on margins in the future.

Starting from a strong level could help cushion the blow. Valuations have come down somewhat in the market correction, but we still view the megacap Growth stocks as expensive relative to history. Therefore, solid earnings growth is important to justify valuations. So far, so good in the Q1 earnings season.

While Q1 earnings are important because they inform the fundamental health of companies today, investors are constantly considering future conditions. That’s why we emphasize trend evidence as well. Last week saw a significant rally attempt, and that is a good start. But history suggests that corrections of speed and magnitude similar to the “tariff tantrum” are met with a future retest of the original lows. Investor sentiment is extremely pessimistic, and technical trends were capitulatory on April 8th.

Any retest should not breach the 5000 level on the S&P 500 by too much, otherwise, the correction could become a more severe bear market. For now, we believe the weight of the indicator evidence is neutral, suggesting investors take a balanced approach to portfolio construction.

Now that you’re up to date on the market happenings, it’s time to go create some memories!

Tim

Enjoyed the maximize memories section of this post!